The current list of cigarette hikes was the subject of curiosity by the citizens after the SCT hike. After the decision published in the Official Gazette on Friday, May 27, 2022, those who want to learn about the SCT increase on tobacco products and alcohol and the details of the decision published in the Official Gazette, do research on the internet. So, how much was the increase in cigarettes on May 27? Here are the current cigarette prices after the SCT hike…

MAY 27 IS IT TIME FOR SMOKING?

The special consumption tax rate on cigarettes and alcoholic beverages was increased.

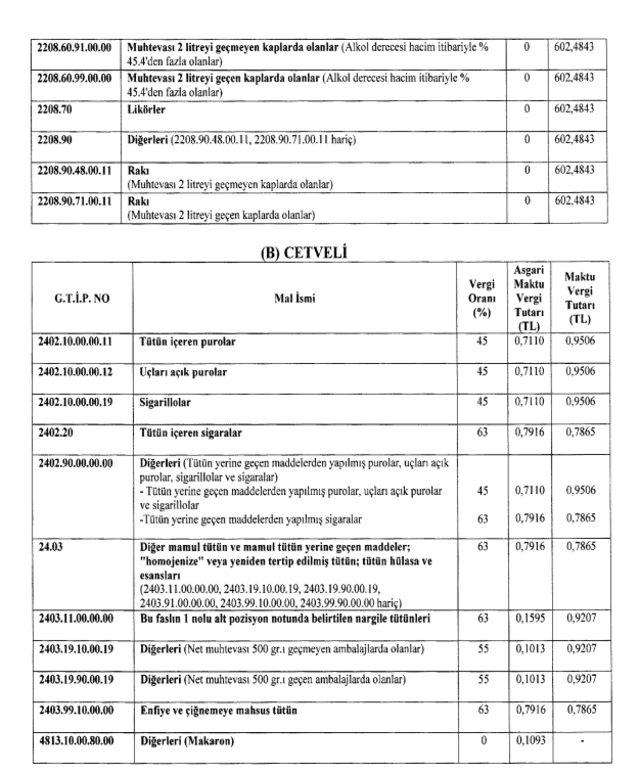

The SCT amount per liter of raki was increased from 481.98 TL to 602.48 TL.

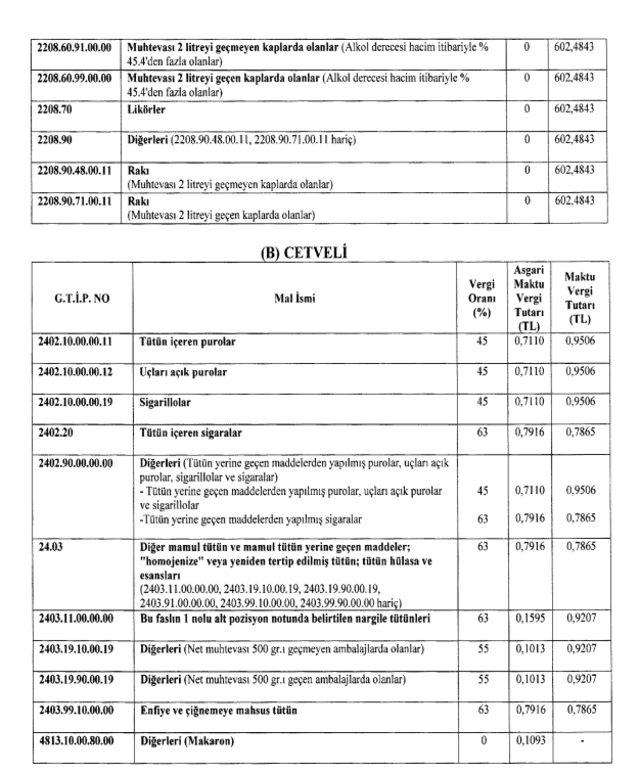

The minimum specific tax amount on cigarettes, which was 0.71 TL, became 0.79 TL.

HOW MUCH IS THE CHEAPEST AND MOST EXPENSIVE CIGARETTE?

After the May cigarette hike, the lowest cigarette price was 25.50 TL, while the highest cigarette price was 40 TL.

HOW MUCH DID THE SPECIAL CONSUMPTION TAX INCREASED?

There was an increase in the Special Consumption Tax (SCT) rate for alcoholic beverages and cigarette products. According to the decision published in the Official Gazette, the rate of increase in SCT in alcoholic beverages was 25 percent, while the rate of increase in SCT in cigarettes was 10 percent.

The SCT amount per liter of raki was increased from 481.98 lira to 602.48 lira. While the tax for 1 liter of raki increased by 64 lira, the tax increase for 70 raki was 45 lira.

The minimum specific tax amount on cigarettes, which was 0.71 lira, became 0.79 lira. The excise duty on 1 pack of cigarettes increased by 1.69 lira.

WHAT IS SPECIAL CONSUMPTION TAX?

Special Consumption Tax (SCT) is an expenditure tax on certain goods or products on a fixed or proportional basis. It first came to the fore with the changes in the law made within the framework of harmonization with the European Union and was adopted in 2002 with the law no 4760 for the same purpose. SCT is applied to luxuries (jewelry, fur, etc.), harmful to health (alcohol, cigarettes, etc.), harmful to the environment (gasoline, etc.).

SCT, like VAT, does not arise in every handover of the same good. SCT arises due to the import of the goods or the delivery of the produced goods to the first buyer. In motor vehicles, it is necessary to pay SCT on behalf of the final consumer. The taxpayers are the importers and the first sellers.

It is essential to tax the products included in 4 separate tariffs in addition to the law. Tariff No. 1, taxes on fuel and oil derivatives, Tariff No. 2 instead of the old Fuel Consumption Tax, Tariff No. 3 instead of the old Fuel Consumption Tax, Tariff No. 3 instead of the old Vehicle Purchase Tax, Taxes on tobacco and alcohol derivatives, Tariff No. 4 instead of the old Additional VAT, white and brown goods and derivatives taxes have replaced the old Luxury VAT.

WHICH GOODS HAVE SCT?

The subject of which products have ÖTV is also a very curious subject. Products subject to SCT have been determined within the framework of the Special Consumption Law No. 4760. According to the relevant articles, the goods or products counted within the scope of Special Consumption Tax are as follows.

Laissez un commentaire